Investing During An Election Year

Is a Presidential election year a significant event for investors? This question often stirs curiosity among our clients. Every four years, we anticipate this to be the most pivotal election of our lifetime, yet history suggests a different outcome. The stock market’s behavior during these times can be surprising, keeping investors questioning financial moves.

The story of this year is that we have a re-match of two first-term Presidents. Has this happened before? Yes. Six times since the nation was founded. Elected for their second term, both presidents have a track record and would have different priorities for the economy and the country. Politically, both candidates would be considered “lame duck” Presidents with little runway to enact sweeping change, as they could not run for an additional term. We don’t know the outcome of the November election, but rest assured that 50% of the country will be happy and optimistic, while the other 50% will feel the world is ending. I’m not sure that is much different than where we are today.

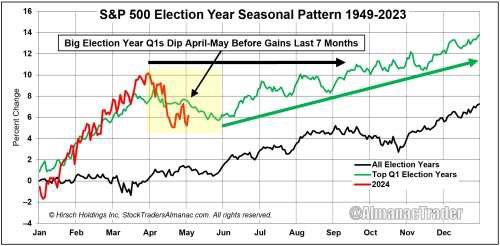

Seasonal tendencies and cycles occur in the stock market. When analyzing these cycles, the stock trader’s almanac can provide a wealth of information. Above is a chart that averages all election years from 1949 until 2023; this is shown as the black line. The green line further filters the election years when the first quarter is strong.

While no one can predict the future, understanding cycles such as the 4-year presidential election cycle can offer valuable insights. They serve as a guide, outlining what is typically expected. Currently, the market seems to be following this pattern, albeit with some fluctuations. This underscores the complexity of incorporating elections into an investment strategy, but also the potential for informed decision-making.

The material has been gathered from sources believed to be reliable, however West Michigan Advisors cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. To determine which investments or planning strategies may be appropriate for you, consult your financial advisor or other industry professional prior to investing or implementing a planning strategy. This article is not intended to provide investment, tax or legal advice, and nothing contained in these materials should be taken as such. Investment Advisory services are offered through West Michigan Advisors. Advisory services are only offered where West Michigan Advisors and its representatives are properly licensed or exempt from licensure. No advice may be rendered unless a client agreement is in place. Securities offered through Level Four Financial, LLC, a registered broker dealer and Member of FINRA/SIPC.