If you are going to donate to charity, it makes sense to do so in a way that provides the most value to you and the non-profit organization of your choice. That’s where tax-effective charitable giving strategies are so important. These strategies reduce the amount of tax you owe and increase the amount of your money that goes to a cause you care about. You both save money and are able to give more at the same time.

In this post we explain how to get that kind of win-win. The following strategies will help you make the most of your charitable giving. You’ll learn skills such as how to avoid taxation on capital gains and how to reduce your taxable income through appreciated asset giving. These strategies don’t have to be overly complicated, but you do have to know how they work for you. So let’s get started:

3 Tax-Effective Charitable Giving Strategies

1. Give Long-term Appreciated Securities (Instead of Cash!)

Who this strategy is for: Anyone with unrealized gains in their investment portfolio.

What it is: When you give a portion of the appreciated securities in your portfolio to a certified 501(c)(3) organization, you can avoid the capital gains taxes you’d have to pay if you sold the shares. Capital gains taxes are the taxes you have to pay on any profits from your assets throughout the year. This strategy offers a win-win situation. You can lock in an income tax deduction for the asset’s fair market value (how much it’s worth), which effectively returns your investment to you. The nonprofit(s) of your choice will get more money than if you gave your after-tax dollars, and they won’t have to pay any capital gains taxes either.

How it works: For example, if you invested $10,000 in a stock that is now worth $30,000, you could sell the stock, recognize capital gains of $20,000, pay capital gains taxes, and have net proceeds potentially less than $15,000. Or, you could give the stock to charity. The charity receives the total $30,000 benefit because it can sell the stock tax-free. Meanwhile, you receive an income tax deduction of $30,000, which has more value than the net proceeds of $15,000 than you would have gotten. In conclusion, the total benefit to you and the nonprofit would be close to double what you would’ve gotten if you sold your asset. Check out the next tax-effective charitable giving strategy if you want to know the best method for growing and gifting your long-term appreciated securities!

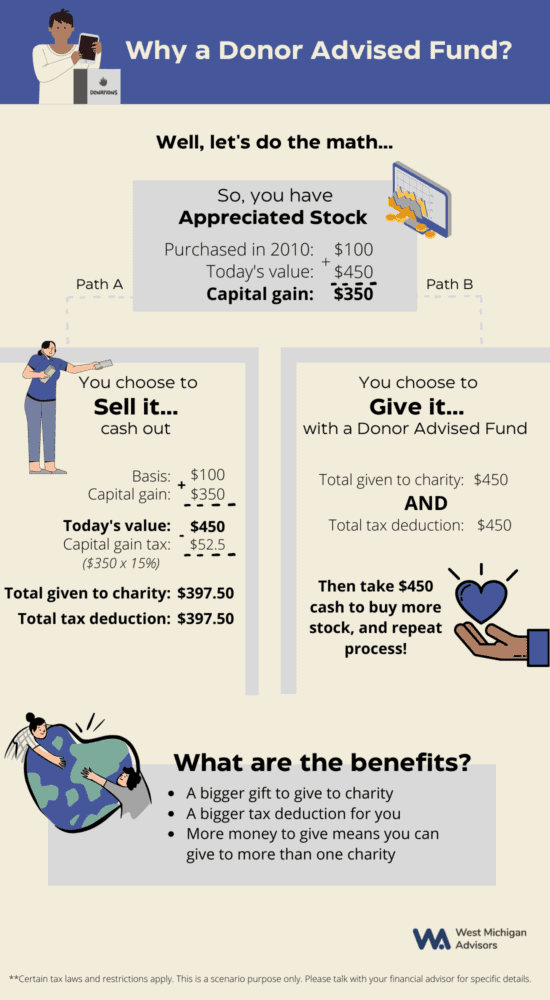

2. Set Up a Donor Advised Fund

Who this strategy is for: The regular giver who wants to simplify their record-keeping and tax process. This is also beneficial for people who will experience a large taxable event, such as selling a business or receiving an inheritance.

What it is: Essentially, a Donor Advised Fund is a brokerage account solely dedicated to charitable giving. If you implement any number of tax-effective charitable giving strategies, a Donor Advised Fund is an efficient vessel for organizing your giving. Not only will it help you maximize your donations; it will also simplify your record-keeping for tax purposes because all of your deductions would be under one name.

How it works: The first step is to set up a fund with a financial advisor like West Michigan Advisors. Then you can donate cash, stock, cryptocurrency, non-publicly traded assets such as private business interests, etc., for an immediate tax deduction. If you invest cash, you are generally eligible for an income tax deduction of up to 60 percent of your adjusted gross income, and up to 30 percent for donations of long-term appreciated assets.

You can fund your Donor Advised Fund with one large gift and claim a tax deduction in that year.Whenever you decide the timing is right, you can give money from this fund to nonprofit organizations. Remember that you get a tax deduction when you put money into your Donor Advised Fund, not when you send money out of it.

While you decide what charities you want to support, your donations will grow tax-free. Note that this kind of donation is irrevocable, so everything you put into the Donor Advised Fund has to go to an IRS-qualified public charity. This is a great option for legacy planning, as funds can be passed along to family members and help ease the burden of potential estate taxes.

3. Qualified Charitable Donations Out of Retirement Accounts

Who this strategy is for: Persons 71.5 years of age or older with a tax-deferred retirement account who want to reduce their income tax liability.

What it is: When the time finally comes to withdraw from tax-deferred retirement accounts such as a 401K or an IRA, it’s also the time to pay income taxes! Annual withdrawals from traditional retirement accounts are required after age 70 ½, and those withdrawals are taxed. The penalty for skipping a minimum distribution is 50 percent of the amount that should have been withdrawn–so you don’t want to miss taking out your money! However, if you have enough retirement stowed away in other funds, you can avoid income tax on your required withdrawal by donating your money to a qualified charitable organization.

How it works: A qualified charitable donation is taken directly out of your retirement account, and you can donate up to $100,000 a year. If you’re married filing jointly, your spouse can contribute $100,000, which means that couples can exclude up to $200,000 of their income tax!

There are several other charitable giving strategies that we didn’t discuss in this blog post, such as charitable remainder trusts and charitable gift annuities. The best plan for you may incorporate a number of different strategies, so schedule a call with one of our advisors to learn which combination is best for you!

The material has been gathered from sources believed to be reliable, however West Michigan Advisors cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. To determine which investments or planning strategies may be appropriate for you, consult your financial advisor or other industry professional prior to investing or implementing a planning strategy. This article is not intended to provide investment, tax or legal advice, and nothing contained in these materials should be taken as such. Investment Advisory services are offered through West Michigan Advisors. Advisory services are only offered where West Michigan Advisors and its representatives are properly licensed or exempt from licensure. No advice may be rendered unless a client agreement is in place.